Our vision is simple but ambitious: to build meaningful partnerships that make financial systems work for everyone. We do this by ensuring they’re easy to reach, relevant to groups without access to financial services—especially women—and built to last beyond any single project cycle.

Our challenge: Testing digital and financial solutions that reach those left behind by formal finance

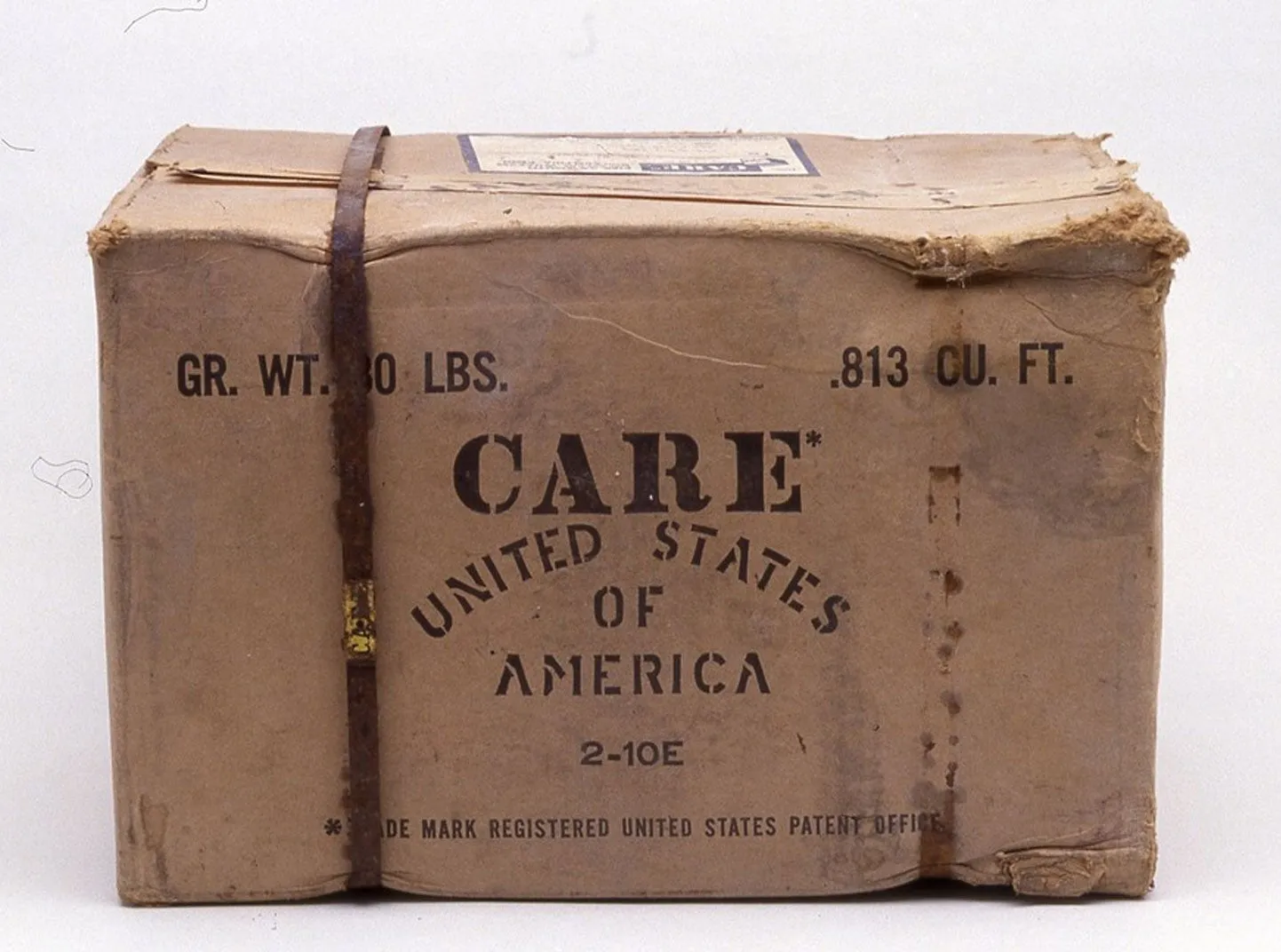

Over the past few years, CARE’s Global VSLA team has been on a multi-country learning journey to test how VSLAs can serve as the backbone of open digital and financial ecosystems. This has come to life through the Digital CARE PACKAGE® box—an integrated framework connecting digital inclusion, financial access, and social norm change, all anchored on our innovative partnership strategy.

We’ve tested and expanded promising models across Uganda, Rwanda, Bangladesh, Malawi, and Sierra Leone. Instead of reinventing the wheel, we’ve learned along the way what works, what must adapt, and how to move from basic access to meaningful financial connection.

Now, with this foundation in place, we’re ready to launch the next phase—turning lessons learned into lasting systems that go beyond individual projects and into everyday life, so women and their families can shape their own financial futures.

Our approach: Charting the path for VSLAs to access credit and capital to unlock greater opportunity

The journey is structured into seven phases, with each phase mapped to a flagship country pilot: