DAVOS (January 22, 2020) –

- SDG500 is a pioneering multimillion-dollar investment platform dedicated to helping achieve the SDGs.

- The investment platform will use debt and equity to bridge the financing gap between seed and growth stage for hundreds of businesses in emerging and frontier markets.

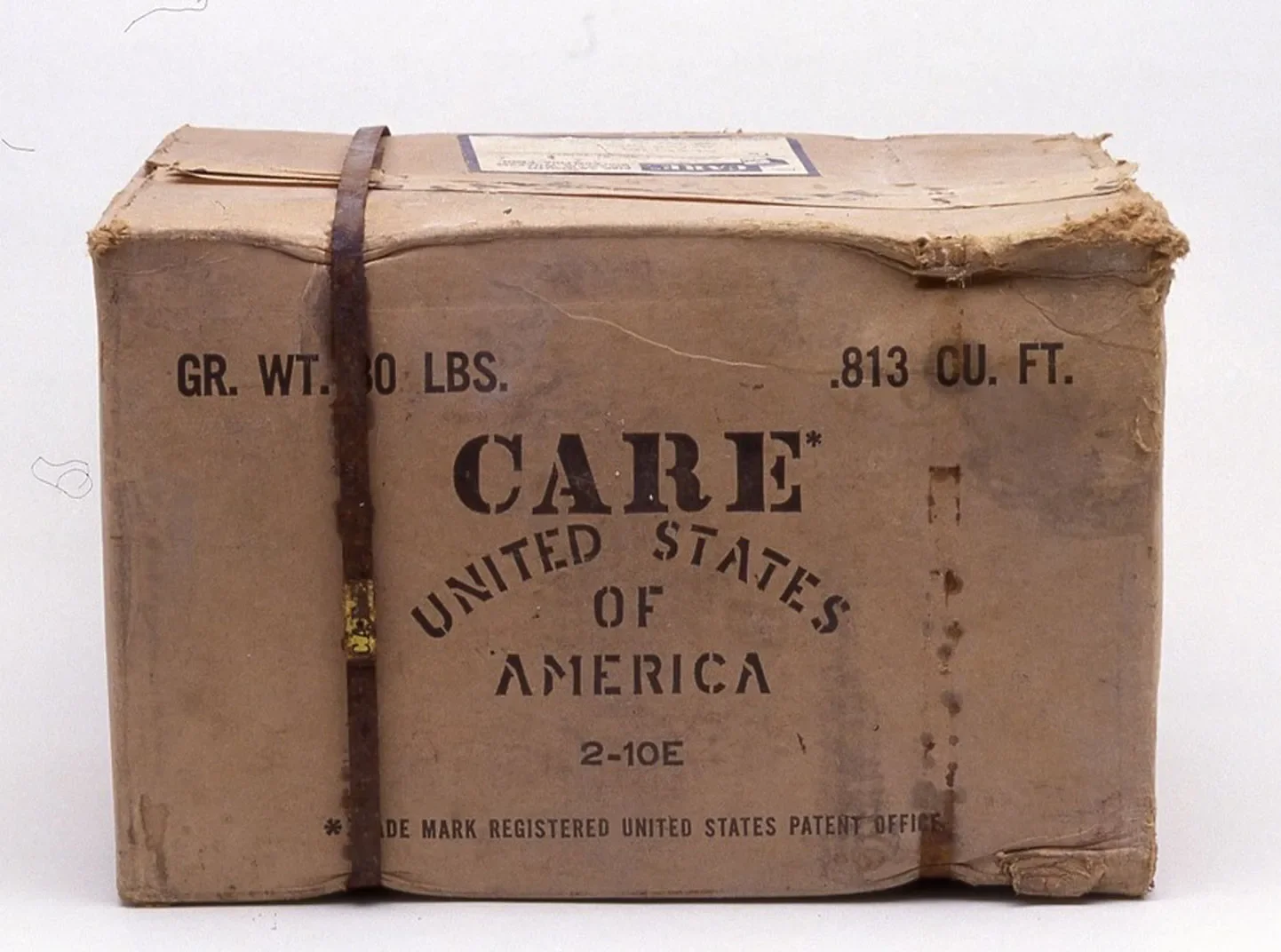

- The coalition partners include: United Nations Capital Development Fund, International Trade Centre, International Fund for Agricultural Development (IFAD), CARE, Smart Africa, Stop TB Partnership and Bamboo Capital Partners. The IDB Lab of the Inter-American Development Bank is an interested party.

A coalition of private and public sector organizations, including United Nations entities, non-governmental organizations and a private equity firm today announces the launch of SDG500 – a new investment platform to help achieve the Sustainable Development Goals (SDGs).

This USD$500 million investment platform is the first-of-its-kind dedicated to helping achieve the SDGs. SDG500 will offer an exposure to six different underlying funds. Each of these funds is or will be managed by impact asset manager Bamboo Capital Partners.

The funds will use debt and equity to invest at Seed, Series A and Series B stages in hundreds of businesses in emerging and frontier markets. SDG500 aims to address the ‘missing middle’ financing gap that affects entrepreneurs in these markets, where growth is constrained by a lack of access to follow-on financing.

The funds will target businesses in the agriculture, finance, energy, education and healthcare sectors across Africa, Asia, Latin America, and the Caribbean and Pacific regions. There will also be a gender-lens focus and some of the funds will specifically invest in businesses that empower and provide jobs for women.

The funds composing the SDG500 platform each include a catalytic first loss layer designed to encourage and protect senior tranches of funding. Initial sponsors of the catalytic layers of the funds of SDG500 include the European Union, the African, Caribbean and Pacific Group of States, the Governments of Luxembourg, Togo and Tunisia, CARE and the Alliance for a Green Revolution in Africa.[1]

The underlying six funds are: the ABC Fund, an impact investment vehicle targeting smallholder farmers and small and medium agribusinesses in developing countries; BUILD, a fixed income fund aimed at early stage enterprises in the Least Developed Countries; the CARE SheTrades Fund, a gender lens fund which will use debt and equity to invest in businesses in Asia; BLOC SmartAfrica and BLOC Latin America, venture capital funds targeting technology enterprises in Africa, Latin America and the Caribbean respectively; and HEAL, a venture capital fund investing in healthtech businesses in emerging and frontier markets.

The financing gap to achieve the SDGs in developing countries is estimated to be US$2.5 trillion per year. To achieve the SDGs by 2030, more innovative and sustainable financing solutions are required. The launch of the initiative will be announced at the “SDG500 Roundtable” which takes place today in Davos, on the sidelines of the World Economic Forum Annual Meeting.

Media Contact:

Vanessa Parra, vanessa.parra@care.org, +1 917-525-0590 (NYC)

About SDG500:

SDG500 is an impact investment platform combining partners from the private and public sectors, including United Nations entities, non-governmental organizations and a private equity firm, to catalyze investments that will help achieve the Sustainable Development Goals (SDGs). The platform will raise USD$500 million for hundreds of businesses in emerging and frontier markets. SDG500 will offer an exposure to six underlying funds targeting businesses in the agriculture, finance, energy, education, and healthcare sectors in Africa, Asia, Latin America and the Caribbean and Pacific regions. It has a gender-lens focus and some of the funds will specifically invest in businesses which empower and provide jobs for women. The blended finance structure of SDG500’s underlying funds is designed to catalyse and de-risk further funding from institutional investors in order to make a significant contribution to achieving the SDGs by 2030.

[1]The European Union, Alliance for a Green Revolution in Africa, The African, Caribbean, and Pacific Group of States and the Government of Luxembourg have committed funding to the first loss layer of the ABC Fund, which has been initiated by IFAD in partnership with them. The Governments of Togo and Tunisia have committed to the first loss of the BLOC SmartAfrica Fund. CARE has committed to the first loss of the Care-SheTrades Fund. Those three funds are part of the SDG500 platform.