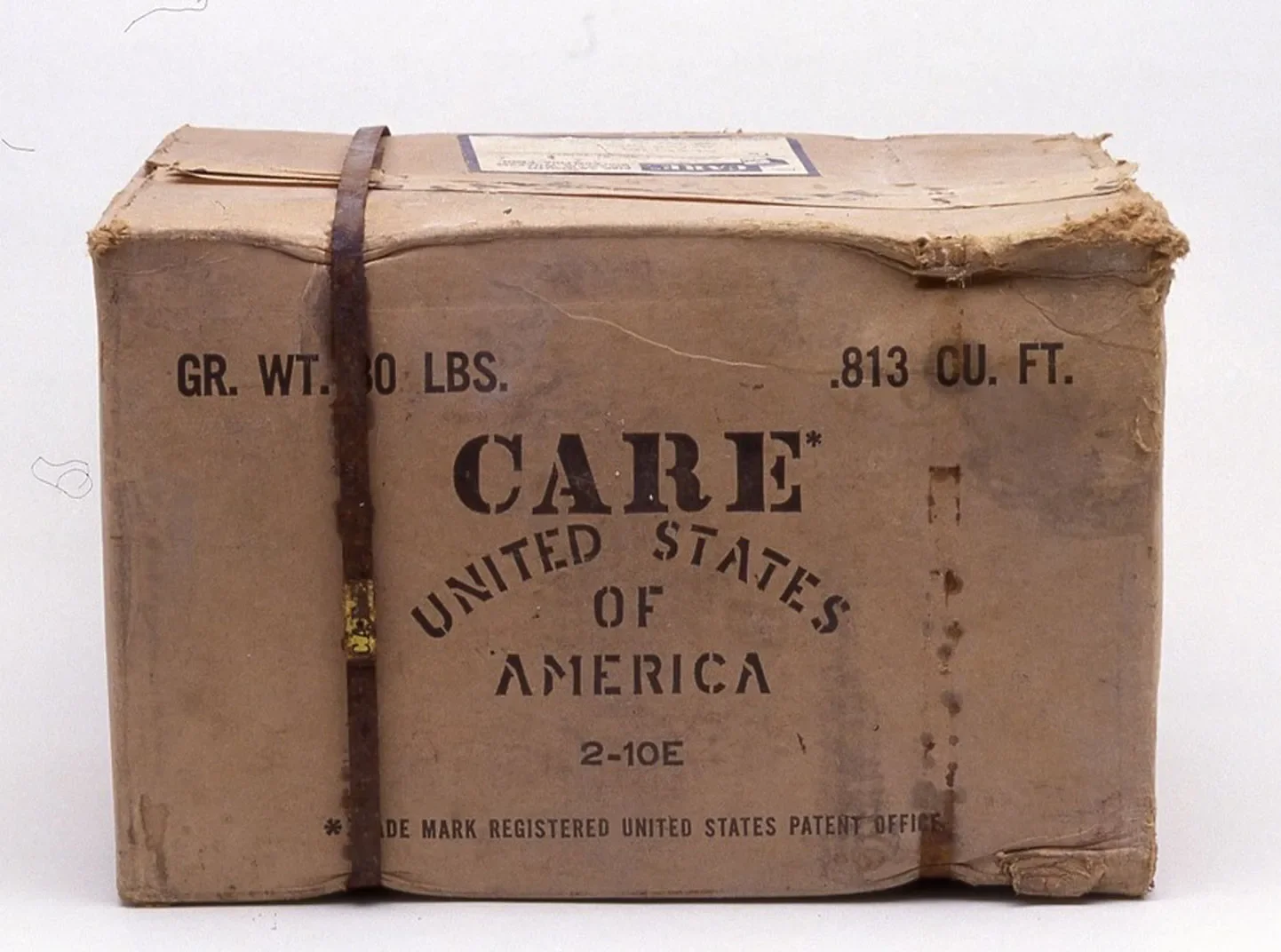

Our target

Micro and small enterprises (MSEs) are the economic backbone of most economies worldwide, yet they remain disproportionately unserved or underserved by financial and non-financial service providers. For women entrepreneurs, access to finance is a major barrier and the finance gap for women globally is estimated at $1.7 trillion USD. Women also face harmful gender norms, restricted digital access, a lack of education and skills, and lack a supportive environment.

CARE’s Women’s Entrepreneurship programming aims to reduce those barriers. We focus on growth-oriented businesses, the majority of which typically have two to ten employees and have been in business for more than two years. By building the capacity of growth entrepreneurs, they in turn can employ more people – mostly women – in their local communities, helping to lift them out of poverty. These growth entrepreneurs are becoming trailblazers for other women in their communities, including their own staff, demonstrating the power and potential of women in business.

Our model

CARE’s entrepreneurship and financial inclusion programming offers a combination of services – both financial and non-financial – that are essential to creating sustainable growth and empowerment for women entrepreneurs. Our market-based approach – working with local financial service providers – ensures that the products and services supporting these entrepreneurs are both sustainable and scalable in the long-term and puts women at the center.