Report makes recommendations for how banks can make financial inclusion more viable

LONDON, England (Nov. 11, 2015) — Banks can address an additional $380 billion market in annual revenues by targeting micro-enterprises and bringing unbanked and underbanked adults into the formal financial system, according to a new report produced jointly by Accenture (NYSE: ACN), through Accenture Development Partnerships, and CARE, a leading humanitarian organization fighting global poverty.

The report “Within Reach” outlines how to make financial inclusion a viable business strategy. It notes that closing the small-business credit gap at average lending spreads and adding fee-based services could generate about $270 billion in additional revenue for banks, while including unbanked adults into the formal financial system could generate another $110 billion, according to Accenture research.*

Until now, supporting financial inclusion has not been viewed as a viable business plan for banks. Seventy-seven percent of the 30 banks surveyed for the report were focused on short-term profit-driven commercial opportunities in a piecemeal manner, or were driven by philanthropic ambitions, the corporate social responsibility agenda or regulatory pressures. Only 23 percent of banks surveyed had financial inclusion as part of a coherent corporate strategy leading to long-term, sustainable investment plans to develop inclusive business models.

“The traditional view has been that banking the unbanked and underbanked tended to be low-end, unprofitable and philanthropic,” said Simon Whitehouse, a senior managing director in Accenture’s Financial Services Operating Group. “But new business models, enabled by digital technologies, are helping banks write a new rulebook for what is possible.”

For example, Janalakshmi Financial Services increased its delivery of microloans to India’s unbanked consumers with help from Accenture in customer onboarding and process operations, doubling the number of loans it disbursed in 17 months. Other banks are leveraging mobile phones in new ways to reach customers; the Zambia National Commercial Bank now serves more than 200,000 customers through a mobile banking service that targeted the unbanked market. And new entrants into financial services are using analytics to improve loan assessments. China’s Alibaba, for example, uses customers’ commercial transactions on its Taobao ecommerce platform to establish credit records and conduct small- and medium-sized enterprise lending.

To make financial inclusion viable, the report advises banks could:

• Simplify existing products and use digital-enabling solutions. NMB Tanzania created an entry-level savings account, targeting Tanzania’s unbanked population through an agent banking model. Agents are equipped with smartphones and point-of-service devices that enable fast account openings (in under 10 minutes) and instant, branch-free transactions.

• Be willing to partner with alternative providers. Fidelity Bank, Visa, telecommunications company MTN and CARE work together with support from FSD Africa to enable community savings groups in Ghana to open and operate a Fidelity Bank Smart account without visiting a bank branch. Opening accounts is entirely digital and can happen in less than five minutes. Group members can access their account through an MTN mobile money wallet.

• Also join forces with the development sector. NGOs can provide access to savings groups; support development of suitable responsible products and services; and provide access to the mobile wallets and agent networks that can help overcome issues of remoteness. In Uganda, Barclays partnered with the Grameen Foundation and Airtel to develop a mobile product, called eKeys, which links a savings group’s mobile money wallet to a Barclays savings account. By visiting any of Airtel’s nearly 30,000 mobile money agents, the savings groups are able to make a deposit or withdraw funds from their bank account anytime, anywhere.

• Use digital to drive efficiencies. Commercial Bank of Africa teamed with Safaricom to launch its M-Shwari mobile banking service. The M-Shwari account-opening process is initiated remotely by the customer, then fulfilled electronically using automated processes to verify know-your-customer information in a few seconds. Tapping into Safaricom’s mobile phone registration data eliminates the need for CBA to conduct additional checks. Customer transactions are 100 percent straight-through, allowing the platform to be supported with only seven back-office and IT staff.

Report co-author Senior Policy Advisor at CARE International UK, Gerry Boyle said: “It may not seem like an obvious poverty fighting tool but providing access to basic formal bank accounts has been proven to have a transformative effect for those living in poverty, especially women. Decades of working in this area has proven that even the poorest, those living on less than $2 can save and make for viable customers.”

“It is clear that many banks recognize the opportunity of greater financial inclusion, but are struggling to make progress,” Louise James of Accenture Development Partnerships added. “This is where cross sector collaboration can play a critical role – by bringing together a range of relevant parties who can help financial institutions build their understanding of the customer needs. These partnerships, while helping banks realize commercial benefits, also ensure that new customers are integrated in a way that underpins wider social development and long term involvement in local commerce.”

Read the full “Within Reach” report here.

* Read Accenture’s “Billion Reasons to Bank Inclusively” report here.

For media requests, please contact:

Nicole Harris, nharris@care.org, 404-979-9503 (office), 404-735-0871 (cell)

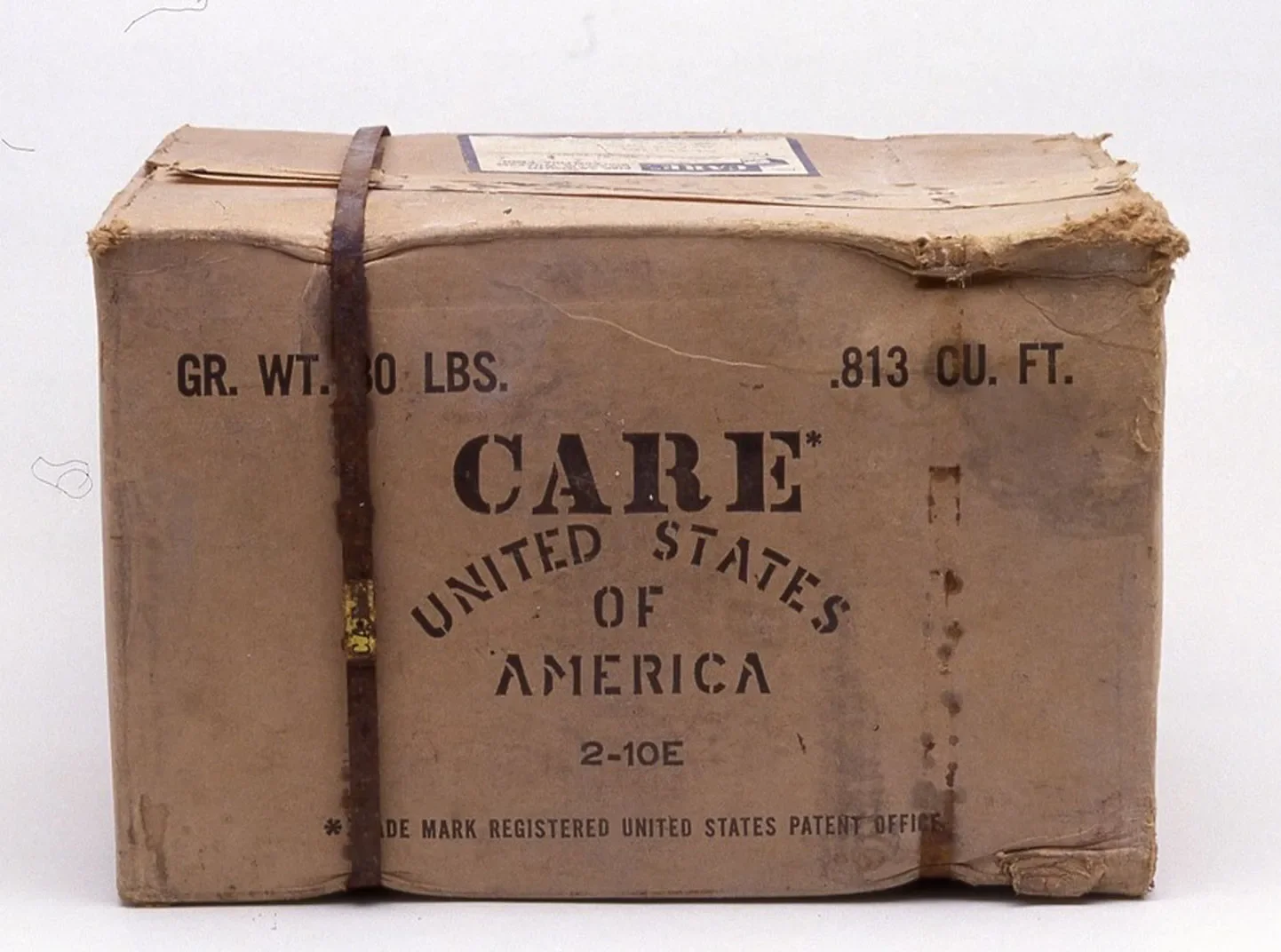

About CARE

Founded in 1945 with the creation of the CARE Package®, CARE is a leading humanitarian organization fighting global poverty. CARE places special focus on working alongside poor girls and women because, equipped with the proper resources, they have the power to lift whole families and entire communities out of poverty. Last year CARE worked in 90 countries and reached more than 72 million people around the world. To learn more, visit www.care.org.

About Accenture

Accenture is a global management consulting, technology services and outsourcing company, with more than 358,000 people serving clients in more than 120 countries. Combining unparalleled experience, comprehensive capabilities across all industries and business functions, and extensive research on the world’s most successful companies, Accenture collaborates with clients to help them become high-performance businesses and governments. The company generated net revenues of US$31.0 billion for the fiscal year ended Aug. 31, 2015. Its home page is www.accenture.com.

About Accenture Development Partnerships

Accenture Development Partnerships employs an innovative business model to provide organizations working in international development with access to world class business and technology consulting, delivering innovative solutions that change the way people work and live. In particular, ADP helps create and facilitate strategic cross sector partnerships to tackle issues with a clear development and business imperative; harnessing the capabilities of diverse partners to drive social and commercial impact.